Analyzing industry should be the first step for investing. There are many quotes by different iconic investors on the same.

If an investor finds a good industry, he has mitigated some of his risk. How? Because if we analyze any industry for a longer horizon, say 10 or 15 years, we can have a decent idea of how the industry is (in terms of profitability). Also by taking a longer horizon, we can be satisfied by the result because any economy can see different phase of economic cycle in 10 or 15 years.

Nature of industry doesn’t change overnight. Example – A tyre industry’s nature will not change in short term (until there is something better than tyre). Tyre is the essential part of vehicles so we can say that tyre industry’s business can’t go out of fashion (although companies working in industry can).

Also Charlie Munger, also known as wisest man alive on Earth, quoted “Fish where the fish are”. This means that if there are two ponds (take this as industry) which have 10 fishes each (fish could be taken as companies). But one pond has 7 rotten fishes and second one has 3 rotten fishes. Where would you fish? Obviously second one because the probability of getting a rotten fish is less in second one.

In the same way, if an industry has companies that are earning profits above their cost of capital for a longer time then it can be taken as a good industry and vice versa.

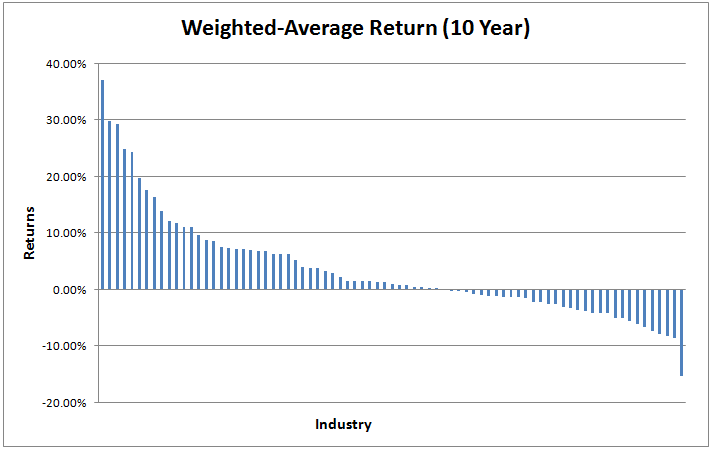

So, today we have analyzed almost 80 sectors of Indian economy. We have taken RoCE i.e. Return on Capital Employed for the calculation of economic profit. Although RoIC i.e. Return on Invested Capital would have been a better measure but we have taken RoCE as a substitute to RoIC. Also we have taken weighted average because there were some companies having extremely higher return but there overall weight in industry was low. This was portraying wrong image of industry. But with the help of weighted average, the return was normalized.

Here is the excel file where all the calculation is done.

Done by Sanjeel Kothari and Kusum Chaudhary