What is Price to Book Ratio?

This ratio calculates the market value of share to its book value. Book value is the net assets of the company. Market price is the current price of the share.

Formula – Market Price per Share / Book Value per Share

This ratio is used by investors to check whether they are overpaying for a particular company’s stock or not.

This ratio can be a bane for service industry because in service sector companies the main assets are its employees and the cost of those employees is deducted in profit and loss account. Hence, the main assets are not on balance sheet and thus lower assets.

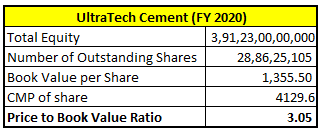

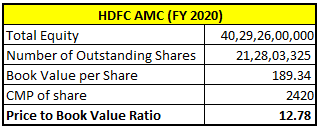

Let’s take two examples to interpret this.

We will take two companies i.e. one is asset heavy and other is engaged in services. For one company its assets are on balance sheet and for another its main assets are on profit and loss account.

As we can see, price to book ratio of HDFC AMC is coming higher but it cannot be said that the investors are overpaying by seeing only this ratio. As the company is mainly engaged in providing services, its major assets i.e. its employees, their cost is deducted in profit and loss account and thus having lower assets and overall net assets are also lower. But in UltraTech cement which is an asset heavy company, its major assets are on balance sheet only and thus higher net assets also.

So, P/B ratio cannot be a great ratio to analyze service sector companies.