Operating leverage means company’s profit is increasing more than the increase in revenue (in percentage terms). Example – Revenue increased by 20% and profit increased by 40%.

Here we will take a hypothetical example of company ‘A’ to understand its good and bad side.

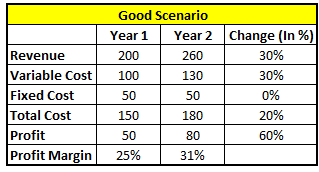

In this case company’s revenue and variable cost both are increasing. But as the fixed cost has not changed, overall percentage increase in total cost is lower than percentage increase in variable cost. Hence, profit margin is increasing.

In this case operating leverage is 2 i.e. For 1% increase in revenue, profit will increase by 2% and vice versa.

But this could turn out to be a bad scenario if market is not in a good position. Let’s see how.

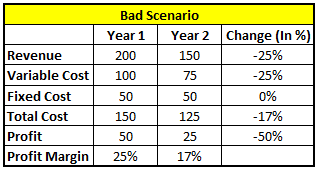

In bad scenario, company’s revenue decreased by 25% and variable cost too decreased by 25%. Although, overall decrease in total cost was lower than decrease in variable cost (in percentage terms). Also, revenue decreased more (in terms of percentage) than cost. Hence profit margin was impacted.

Hence, operating leverage can be good when market is in a good position but if market takes a u-turn then this operating leverage can work in opposite manner i.e. if in good times profit was rising 2% for every 1% revenue increase (assuming operating leverage as 2) then in bad times the profit will decrease 2% for every 1% decrease in revenue.